Playbook: Redefining banking in the pandemic age

The banking sector will be one of the most critical players in the post COVID-19 world and has the power and responsibility to orchestrate a strong global response to the emerging economic implications. Banks are now starting to move beyond just ensuring business continuity, and are beginning to develop new capabilities to guide customers, partners, and the larger society through the crisis and beyond.

To navigate through these challenging times, we recommend initiatives to support customers, manage the business, reinforce confidence in the organization, and support in strengthening the economy and society.

- Remote work and continuity of operations with a reduced workforce.

- Change in channel mix as branch access is restricted.

- Customers' financial hardship and destabilized financial markets impacting profitability.

- Government assistance schemes being created to support customers' indebtedness.

- Shift to cashless payments with a major move to digital shopping.

- Focus on efficiently using limited people resources, supported by automated tools.

- Increasing digital engagement for customers.

- Improving contact center efficiency and effectiveness

- Banks acting fast to implement processes for government schemes.

- Remote trading technology to provide business continuity while ensuring compliance.

Find areas that banking customers should focus on, and engage with them on specific actions and how you can solve their problems. Identify ways to address the customers' short-term issues and enable a simple evaluation of your services.

Initiate remote work working while addressing bank privacy and compliance challenges. Also, work directly with customers, ensuring the continuous delivery of contracted obligations.

Managing the phases of the economic downturn will determine the future health of your organization. Here's how to focus on the corrective actions to take during each phase of a crisis:

Mitigation

- Redeploy resources to aid business in crisis management – build war room environment to surface relevant, dynamic, and daily insights.

- Maintain effective operations on ongoing projects during disruption and support cost optimization activities.

Post peak

- Provide insights to track business recovery, consumer behavior and market conditions

- Differentiating temporary shifts in behavior from lasting changes, and scenario planning the implications for the new business strategy.

Cautious recovery

- Assist in incorporating analytics into new strategy, identifying opportunities and risks

- Re-shape project portfolio based on likely scenarios for new normal

- Re-orient team capacity, to support likely strategic pivot while continuing to ensure safe working practices.

New normal

- Higher need for short-term business impact for initiatives, although overall spend may remain constant.

- Meeting business need for responsive insight to understand ‘new normal’.

- Considering changes in ways of working, e.g. acceleration of remote working and use of online channels.

Our recent work with banks

An effective way to enable clients to respond decisively, effectively and with confidence is handling workflow through triage. The crux of customer request triage is sorting jobs into multiple levels of effort required. Our approach to organize and manage workflow is achieved by:

Data annotation

- Build an exhaustive list of intents that could include all customer queries and resolutions

- Group similar queries, requests, and tasks into categories

Model development

- Develop a mechanism to verify and validate the manual labeling and categorization of user intent

- Create a baseline model to understand the predictive power within the chat logs

Evaluation

- Analyze the model outputs to classify and prioritize intents to improve routing effectiveness as well handle the volume surge

Executives need to be on top of the constantly shifting environment. A central business nerve center that is powered by data; a single source of truth that will give a clear understanding of how different channels are reacting to the crisis, studying the recovery graph, whether it would be sharp or prolonged, and how will the consumers change.

We have curated a solution so that you stay on top to monitor the evolving effect of Covid-19 on your business and strategize your countermeasures.

To enable this:

Cuddle.ai acts as your central nerve for your business. It helps you understand and interpret data on the go by combining strong external signals like different channels reacting to crises, recovery path, and enterprise data to give you a complete picture.

The pandemic is resulting in a systemic change in consumer behavior towards digital, and they expect their banks to provide seamless, empathetic, and relevant service experience as they have been used to in branches. Banks have been dabbling with efforts to provide frictionless digital customer experience, and Covid-19 has accelerated a number of banks’ attempts to do this at scale. Our Automated Insights for Digital Evolution (AIDE) solution is being deployed to identify and eliminate friction points, detect root causes and enable the completion of customer journeys, leading to fast and significant increase in conversion rate, number of products per customer, and complaint resolution along with a reduction in cost to serve.

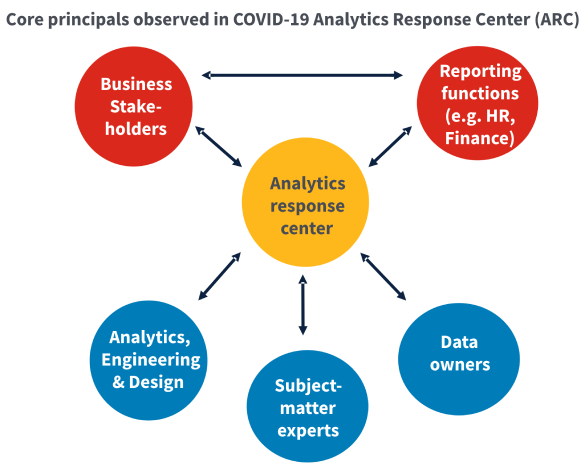

Bringing together AI, Engineering, and Design, the Analytics Response Center (ARC) builds rapid solutions to update revenue/churn forecasting, detect newer patterns of fraud, reduce waiting and handling time metrics for contact centers, and disseminate insights at speed. It helps build clear communication lines to identify and prioritize requirements, establishing a single source of truth.

Our Thinking

Case Studies

-

4 min. read

4 min. readPutting the spark in your client relationships

Develop deep, revenue-generating client relationships with data-driven insights.

-

4 min. read

4 min. readSweeten the buyer journey for your customers

70% of digital buying journeys start but only 1% end in a purchase. Our case study reveals how we reduced dissonance and boosted CLV by $1B for a Fortune 100 company.

-

5 min. read

5 min. readFortune 50 bank improves intelligence, decision making with Customer Genomics Framework

A leading retail bank identified silos and fragmented data practices hindering customer experience and team performance. They tackled this with a tailored AI solution, aligning business and data teams

-

7 min. read

7 min. readFranklin Templeton generates $600mn in new assets with Customer Genomics®

Machine learning helps deliver highly personalized interactions to financial advisors to drive sales.

Company Background Franklin Templeton Investments (FTI) is one of the world’s largest asset managers, selling mutual funds to investors through financial advisors (FA). One of FTI’s chief goals is to increase...

-

2 min. read

2 min. readA leading private bank leverages behavioral sciences to improve delinquency resolution

Transforming delinquency resolution in the banking sector with the power of behavioral sciences.

The Big Picture Delinquency is not only an unfamiliar situation for credit consumers but also one which is most often accompanied by temporary/permanent financial difficulty. Therefore, consumers display very little...

-

1 min. read

1 min. readAutomate insight generation from unstructured sources

A major US mutual fund automates insight generation using unstructured data from analyst reports.

The Big Picture Asset management companies are perpetually in the race to capture mind-share from financial advisors by being relevant, contextual, and timely to drive product sales and adoption. A large portion of...

-

1 min. read

1 min. readRecommend replacement products to advisors to drive sales

A wealth manager develops a recommendation platform, resulting in a $1.5B incremental opportunity.

The Big Picture Financial advisors, looking to add value to consumer investors, frequently rebalance their portfolios to keep with investor’s needs for risks and gains. This presents an opportunity for asset...

-

2 min. read

2 min. readIdentify major customer events using analytics

A bank uses analytics to identify moments in the customer journey that lead to likely attrition.

The Big Picture A leading bank had the highest share of young adults in the 18 to 26 years age group, but the proportion tails off in the subsequent older age groups. Given that customers’ profitability peaks in the...

-

1 min. read

1 min. readDeliver next best product recommendations during customer interactions

A bank uses advanced deep learning algorithms to determine next optimal product and service to existing customers.

The Big Picture: A leading retail bank was facing low customer engagement and satisfaction with its customers. The existing analytical models on product propensities generated lower accuracy, and missed critical data...

-

1 min. read

1 min. readIdentify preferred store locations to enable personalized marketing

A payment provider traced customer geolocation and transactions data to personalize marketing.

The Big Picture A leading payment provider wanted to understand the relationship between a shopper’s home location and preferred store locations in order to improve marketing efforts and make store-related business...

-

3 min. read

3 min. readGlobal accounting firm leverages FractalGPT to automate employee support and improve compliance...

FractalGPT automates employee support and improves compliance across multiple internal processes.

Summary FractalGPT is a generative AI-powered platform that was customized and deployed to provide employees access to internal knowledge around compliance, HR policies, and IT through an intuitive and engaging natural...

-

2 min. read

2 min. readLarge Australian bank identifies the root cause of customer DSAT and enhances self-service...

Business challenge A large Australian bank found itself overwhelmed by the volume of customer interactions handled by their contact centers every month. Thousands of calls and chats were happening, but the bank lacked...